6 Benefits of 10b5-1 Plans to Consider

Learn about how Rule 10b5-1 works, its benefits, who can use it, and the best ways to take advantage of the trading plan while complying with SEC regulations.

To avoid accusations of insider trading and comply with SEC regulations, company insiders can formulate a 10b5-1 plan. These written plans allow employees to make pre-planned transactions with their company stock in accordance with SEC rules.

This article explains the establishment of Rule 10b5-1, describes how plans are created, and explores the benefits of using such plans for company shareholders, directors, and other insiders.

This article will be broken down into 8 parts:

- What is Rule 10b5-1?

- How does it work?

- FAQ

- The benefits of Rule 10b5-1

- Why was it created?

- Best practices

- Who can use a 10b5-1 plan

- Possible plan changes as of 2021

What Is Rule 10b5-1?

Rule 10b5-1 allows insiders of publicly traded corporations to set up a trading plan to sell and purchase stocks.

Corporate executives use 10b5-1 plans to help avoid accusations of insider trading, or the illegal practice of trading on the stock exchange using confidential inside information. Under the rule, company insiders sell a predetermined number of shares at a predetermined time (even during blackout periods).

The rule stops insiders from changing or adopting a trading plan if they possess material nonpublic information, or MNPI. MNPI refers to any data that relates to a company that is not public but could have subsequent influence on its share price.

Rule 10b5-1 plans must be established in good faith prior to an individual corporate executive’s knowledge of any MNPI.

How Does Rule 10b5-1 Work?

Corporate insiders, including directors, officers, shareholders, or anyone who has access to material nonpublic information, must establish a written plan that explicitly details predetermined times to buy and sell company stock. The written plans are a contract between a corporate insider and their broker.

The trading plan must follow specific requirements in addition to having no access to MNPI at the time of their establishment, including:

- Specification of both price and amount: Dates of sales or purchases must be included, and may also include a set price. The set price is defined as the market price on a particular date or a limit price, or a particular dollar price.

- Formula or metrics: A written formula, metrics, computer program, or algorithm for determining the amount, price, and date must be provided.

- Exclusive right to the broker: The broker must have the exclusive right to determine when to make sales or purchases, as long as they do not have any access to nonpublic information.

The plan must also be entered into in “good faith,” meaning that it is not a part of a scheme to avoid SEC regulations. The good faith provision of the rule gives the SEC the right to challenge and investigate when they suspect abuse of the rule.

Recently, SEC enforcement of these rules has grown and become more visible with increased public scrutiny toward company insiders and the validity of their trades. More guidance was added to the rule in 2009 after the SEC took action against Countrywide Financial CEO Angelo Mozilo, who used his Rule 10b5-1 plan to trade illegally using inside information.

Rule 10b FAQ

Yes, individuals can customize their plans to best fit their wealth management needs. Trading plans can be set up to sell a large number of shares at once, or a smaller number of shares on specific days, weeks, or months. When you design your plan to fit your specifications, you should also consult with your company’s legal and compliance officers to make sure you’re following all available rules and guidelines.

A person who holds a Rule 10b5-1 plan can amend their plan only when they do not possess material non-public information at the time of modification. However, modifications are not recommended because they call into question the insider’s motives, and could be perceived as manipulation of the plan using MNPI. Plans should be designed in order to prevent the need for amendments in the future, and any necessary modifications should be tied to major events in an individual’s life, such as the purchasing of a home.

Rule 10b plans have no restrictions on the number of securities that they can cover. You can design your plan to cover all of your holdings, or only a small portion of them. However, to avoid the need to make modifications, make sure that your plan covers enough securities. You should also not use the plan to cover your entire trading portfolio, though, as that would make it difficult to engage in legitimate trading outside of the plan.

No, Rule 10b plans prohibit entering into or altering a corresponding or hedging transaction or position when it comes to securities protected by the plan. Affirmative defense will be inapplicable to both the trade within the plan and the hedging transaction.

What Are the Benefits of Rule 10b5-1?

- Affirmative defense: To avoid allegations of insider trading cases, Rule 10b5-1 plans provide an affirmative defense, allowing people to refute allegations of wrongdoing, for insiders who trade according to the SEC policies. If an insider is accused of using material nonpublic information, they can use their plan to demonstrate that their sales or purchases took place within the confines of a properly-designed and compliant Rule 10b5-1 Plan.

- Certainty: For insiders planning securities transactions, these plans provide greater certainty as they map out exactly when and how much transactions will cover.

- Opportunities: Insiders will have more opportunities to sell securities, especially if an issuer’s trading policy allows for trading during blackout periods. Insiders will have access to secondary markets as well as liquidity during these blackout periods instead of only trading during open trading windows.

- Diversification: For individuals using Rule 10b plans, diversification of concentrated equity positions will gradually happen at predictable intervals.

- Less negative press: Access to inside information always comes with pitfalls, and these plans help avoid the publicity associated with insider trading scandals.

- Decreased burden: For brokers and trading compliance officers, there is less burden when making investment decisions on an individual basis every time an insider wants to buy or sell shares.

Although Rule 10b plans focus on publicly traded stock, their protections extend beyond typical stock options. Private equity funds or distressed debt investors can use such plans to make future acquisitions or dispositions of company equity or debt without violating insider trading policies.

Companies benefit from their employees’ use of Rule 10b5-1 as well; when individuals adopt a Rule 10b5-1 plan, that reduces a company’s burden of responsibility in their scrutinization of employee trading and helps them avoid becoming another insider trading case.

The rule also allows companies to align their investment objectives along with their insider’s investment decisions.

Why Was Rule 10b5-1 Created?

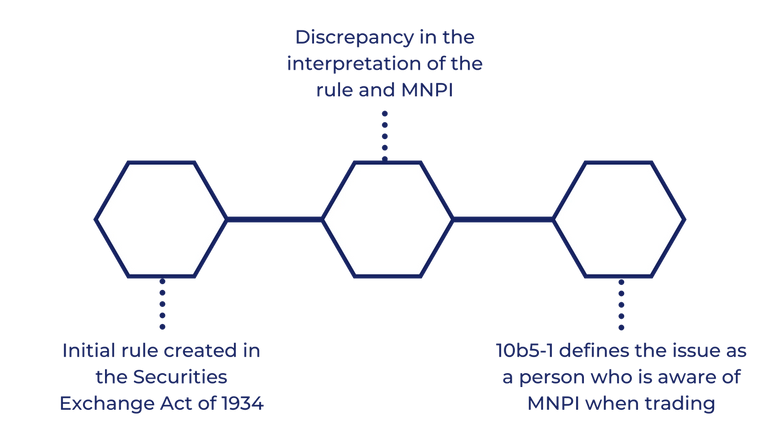

Rule 10b5-1 was created to help clarify the initial rule in the Securities Exchange Act of 1934 that made it illegal for people to make false claims or omit information in order to commit fraud or deceit, in connection with the purchase or sale of securities.

Prior to the rule being amended in 2000, the United States Supreme Court defined insider trading as a purchase or sale made “on the basis” of material non-public information, but the Court of Appeals did not uniformly interpret this statement. Some courts interpreted the rule as referring to any insider being in “possession” of MNPI while others interpreted it as when an insider used that information while making transactions.

In order to avoid confusion, give insiders a broader awareness of the regulations surrounding insider trading, and also provide them with an affirmative defense, the SEC established Rule 10b5-1. The rule defines trades made on the basis of MNPI as a person who is aware of the MNPI when the sale or purchase is made. The rule provides an affirmative defense of the Rule 10b5-1 Plan available to any person or entity.

Best Practices for Rule 10b5-1 Plans

Corporate executives and others with inside information who want to avoid allegations against misuse of such information should consider the adoption of the following best practices:

- Establishment of plan: Establish Rule 10b5-1 plans only during open trading windows in a show of good faith.

- Waiting period: Establish a waiting period between when the plan is adopted and when securities trading begins. It’s recommended to make this waiting period at least 30 days.

- Term and form of plan: Use a pre-approved form of plan, and consider the minimum and maximum terms of use for it. Review the plan once a year to make sure that it’s still relevant to your financial objectives.

- Use one broker: All insiders at a company should use the same broker. Once the plan is adopted, there should be no correspondence between the administrating broker and the trading party.

- Parameters for trading: Prohibit large sales at the initiation of the plan.

- Do not allow modification, termination, or suspension: Limit any changes to the plan to open trading windows. Companies should also have a waiting period before trades can be reinstated in case modifications or suspensions must occur.

- Disclosure: Disclose not just the adoption of the plan, but also any modification, cancellation, or suspension. This can be disclosed via press release followed by a Form 8-K, or simply by filing Form 8-K.

- Disallow multiple plans: Rule 10b5-1 plans should not overlap, as it can raise suspicions about avoiding regulatory bodies. One plan should be flexible enough and have enough room for diverse trading strategies that multiple plans will not be necessary.

- Limit trades outside of plans: After a plan is established, outside trades should be kept at a minimum. While an insider is allowed to trade outside of the plan, the affirmative defense of Rule 10b will not apply to outside trades.

In response to public scrutiny, some companies have also mandated longer cooling off periods between the creation of a plan and its execution, discouraged employees from making major changes to their plans before news events that could impact a company’s stock price, and encouraged employees to trade during open windows.

Most companies require approval of any Rule 10b plan before it’s adopted, and all companies require notice that a Rule 10b plan has been established.

Who Can Use Rule 10b5-1 Plans?

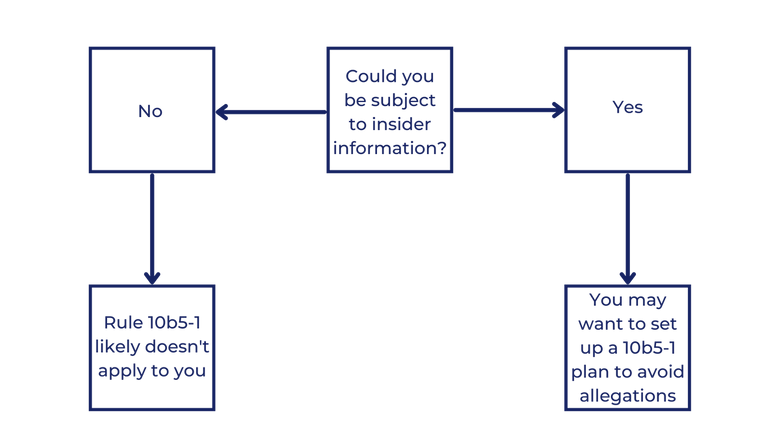

Both individuals and entities can form Rule 10b5-1 trading plans. Most commonly, executives, directors, and other company insiders will utilize the plans to purchase and sell the issuer’s shares.

However, Rule 10b5-1 plans are not limited only to directors or major shareholders in a company; any person or entity can establish a plan, as long as they are not aware of any MNPI and the plan is not a scheme to avoid insider trading prohibitions.

While the plan is most useful for insiders, a person does not have to be an insider of an issuer of company securities to establish a plan. For instance, an intern, secretary, customer, or supplier of a company may want to set up a plan to purchase the issuer’s securities while avoiding allegations of insider trading.

Entities can also establish Rule 10b5-1 trading plans, including issuers and investment banks. They simply have to prove that the individual who makes the investment decisions on behalf of the entity did not possess MNPI, and show that the entity implemented policies and procedures to prevent insider trading.

👉 Visit our homepage to get started with your 10b5-1 plan.

Possible Plan Changes as of 2021

In 2013, the Wall Street Journal reported the possible abuse of Rule 10b5-1 plans by directors and other corporate insiders. In response to these and other allegations of the plans being easily manipulated and abused by bad faith actors, SEC policies and regulations are changing.

In June 2021, Securities and Exchange Commission (SEC) Chairman Gary Gensler announced plans to revise the regulatory rules around Rule 10b5-1 plans. These are the four areas that Gensler pointed to as places for improvement with a need for more trading restrictions and extensive regulation:

- Cooling off periods: SEC staff is being asked to consider a longer waiting period between the creation of the plan and an investor’s first trade, also called a cooling off period. Gensler’s current recommendation is four to six months, as the absence of a cooling off period has led to a possible loophole that allows illegal insider trading.

- Limitations on termination: Currently, there are no limitations on an insider’s ability to terminate their plan and they can cancel it at any time, which makes it easier for insiders to engage in fraud.

- Mandatory disclosure: Although many companies do disclose their Rule 10b5-1 plans, there is no legal requirement to do so. Gensler believes a mandatory disclosure amendment will contribute to more investor confidence in the stock market.

- Number of plans: There is also a lack of formal requirement surrounding the number of plans an insider can adopt, leading some to enter multiple plans and terminate those that are working less successfully, again making fraud easier.

While Gensler’s remarks are directed at the SEC staff, it remains to be seen whether or not they will be adopted into official SEC rules and regulations.

Takeaways

Rule 10b5-1 will continue to grow, and there will likely be more amendments to the rule soon that regulate insider trading and prevent fraud. Although it can be complex, keeping all of the requirements of the plan in mind as well as how to best utilize the plans to avoid allegations of insider trading can benefit you and your investment strategy.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.