Bonds vs. Stocks: What's the Difference?

A comprehensive comparison of bonds and stocks and how to invest in both.

When deciding how to invest your money, one of the first factors to consider is your portfolio’s ratio of stocks and bonds. Although the two investment vehicles are often grouped together, they both have unique benefits and drawbacks for investors.

Many financial advisors suggest dividing your funds based on your personal risk profile. In order to figure out the right allocation for you, it’s important to understand the similarities and differences between the two asset classes. Let’s talk about stocks and bonds, how they compare, the pros and cons of each and how to use them in your portfolio.

What Is a Bond?

A bond is a type of fixed income investment in which the investor loans money to a borrower. In return, the investor will receive a certain amount of interest over time. At the maturity date, or the end of the term of the loan, they’ll collect the full amount borrowed.

Bonds are typically issued as a means of raising funds for a large organization. Investors can choose from a variety of types, including government bonds, municipal bonds and corporate bonds. They’re seen as a form of debt on the part of the borrowing entity, as opposed to stocks, which are considered equity.

Do bonds carry risk?

Because they pay out a fixed amount of interest, bonds are usually understood as a safer investment. However, they’re still susceptible to defaulting if the issuer runs out of money. In that case, the investors could not only miss out on future gains, but they may even lose money overall. While a defaulted bond doesn’t always mean you’ll lose the entire principal, or original investment, you’ll often only receive a fraction of it.

Fortunately, investors can avoid bonds that are more likely to default by checking their ratings before making a purchase. Bond ratings indicate the creditworthiness of a bond, or how likely it is to pay out.

Depending on a company’s financial health, its bond ratings can fall into a wide range of buckets. However, you can separate them more generally into investment-grade and junk bonds. If you’re following the Fitch Ratings, investment-grade bonds range from AAA to BBB. Anything rated BB and below is a junk bond.

Does the value of a bond change over time?

Whereas most stockholders receive returns from their investments gaining value over time, bondholders mainly profit off of their bonds’ fixed interest payments. However, that doesn’t mean that a bond’s value is completely stagnant.

Rather, the price of a bond often fluctuates constantly based on the current interest rate:

- When the current interest rate is lower than a bond’s interest rate, the value of that bond will increase due to increased demand

- When the current interest rate is higher, the opposite will be true

How Do Bonds Work?

As previously mentioned, bonds are issued by organizations that need to raise money for expenses such as projects, growth initiatives or day-to-day operations. Before purchasing a bond, an investor should be aware of three key characteristics:

- Par value: the price at which a bond is issued, also known as the face value; the bondholder will receive this amount back when the debt is repaid

- Coupon rate: the interest rate of a bond, calculated by dividing the annual coupon payments by its par value

- Maturity date: the end of the term of a bond, when the original amount is due to be repaid and after which coupon payments will end

While all bonds follow the same basic structure, the way they work may vary widely depending on their terms. Let’s go over some of the main types of bonds.

Secured vs. Unsecured bonds

The difference between secured and unsecured bonds is based on how the borrower guarantees the loan.

Because secured bonds are safer, unsecured bonds tend to be high-yield in comparison to make up for their increased risk.

Coupon vs. zero-coupon bonds

Most bonds fall under the category of coupon bonds, meaning that they pay out interest on a regular basis. Typically, you’ll receive the payment, or coupon, twice a year. Then, at the end of the term, you’ll receive back your original investment on top of the final interest payment.

However, with zero-coupon bonds, you’ll receive all of your interest in a single payment when the bond reaches maturity.

What Is a Stock?

A stock is an investment that represents an ownership stake in the underlying company. Stockholders make most of their returns from share price movements. Therefore, when choosing which stocks to buy, investors will seek out companies that they predict will perform well.

In addition to profiting off of stock sales, some investors may also make returns from dividends. A stock dividend is a portion of company earnings paid out to shareholders. They’re typically offered by larger, more established companies.

Depending on the organization, dividends are often paid out quarterly or semiannually, and the amount will vary depending on the company’s performance. While some investors compare them to bond coupon payments, they’re typically much smaller and less consistent.

How risky are stocks?

Compared to bonds, stocks are known to be a much riskier investment. Especially for stocks that don’t pay dividends, their value is rooted in their price, which is inherently volatile. However, in exchange for the greater risk, they often yield higher returns. Additionally, many investors will diversify their stock portfolios in order to achieve more consistent returns.

Common vs. Preferred Stock

When making investment decisions, it’s important to know the difference between common and preferred stocks. If you’re like the average investor, you’ll probably encounter common stock the vast majority of the time. However, each type has its own unique advantages and drawbacks.

Common stock

Common stock, also known as ordinary shares, refers to the most basic form of equity. If you’re buying shares on an exchange, it’s most likely common stock.

Investors in common stock receive shareholder voting rights, which they can exercise at annual general meetings (AGM). They can also send in a proxy form with their vote if they aren’t able to attend. If the company pays out dividends, common shareholders will receive payouts on a variable basis.

Preferred stock

Preferred stock is very similar to common stock in that its value is based on the performance of the underlying company. However, the advantage of preferred stock is that shareholders receive guaranteed dividends at a fixed rate. They’ll also be prioritized in the order in which the company makes payments. As a result, they’ll typically continue receiving payments during quarters in which common stockholders won’t receive dividends.

However, there are a few disadvantages to preferred stocks. For one, they don’t come with voting rights. Additionally, since they earn fixed dividends, shareholders may miss out on profits if the company overperforms. Finally, since preferred shares make up only a fraction of assets on the stock market, they typically have lower liquidity. Therefore, shareholders may face more difficulty and higher transaction costs when they try to sell their equity.

Overall thoughts

The name “preferred stock” may suggest that it’s superior to common stock. However, it’s more accurate to think of them as different types of stocks.

Some consider preferred stock a better option for investors with a low risk tolerance, such as retirees. Contrastingly, common stock may be better suited for investors who prefer higher risk in exchange for higher reward.

How Do Bonds and Stocks Compare?

The key differences between stocks and bonds primarily rest on how they pay out income to their investors:

- Whereas bonds yield consistent interest, stocks generate returns based on how their prices change over time.

- Except in the case of default, bond payments are mostly fixed regardless of a company’s performance. However, stock gains are typically highly correlated with company news and earnings.

Stocks and bonds also have a fair amount of similarities:

- For one, they can both be resold for a profit after being issued.

- Additionally, aside from their variation, stock dividends are often similar to bond coupons. For that reason, many investors compare coupon bonds to preferred stock.

Pros and Cons of Each

The differences between stocks and bonds don’t make one strictly better than the other. Rather, it’s crucial to understand the benefits and drawbacks of each in order to create the right investment strategy based on your circumstances.

Pros of Bonds

Buying bonds has a lot of benefits for investors. To start, their value does not fluctuate much over time. For this reason, they’re a relatively safe investment, which makes them a popular choice for individuals close to retirement. On top of that, they offer consistent returns, allowing investors to more accurately predict future gains.

Cons of Bonds

Despite their benefits, investors don’t typically build their portfolios entirely from bonds, mostly due to their lower returns. For instance, if you invested $10,000 in the bond index iShares Core U.S. Aggregate Bond ETF (AGG) in October 2011, you would have $13,342.23 by October 2021. Contrastingly, if you invested that same amount in Invesco QQQ Trust Series 1 (QQQ), an ETF that tracks the Nasdaq, you would end up with $72,747.54.

Pros of Stocks

As you may have guessed, one of the main advantages of buying stock is the strong returns. However, they’re also a popular choice for investment portfolios due to their accessibility. While bond prices typically start at a minimum of $1,000, most stocks trade at much lower price points. Therefore, it’s much easier to create a diversified portfolio by buying stocks without investing a lot of money.

Cons of Stocks

As previously discussed, stocks are more volatile than bonds, making them a risky short-term investment. Additionally, because stock price movements are unpredictable, it’s more difficult for investors to control their risk. Fortunately, many investors manage their portfolios with the help of a certified financial planner or a robo-advisor.

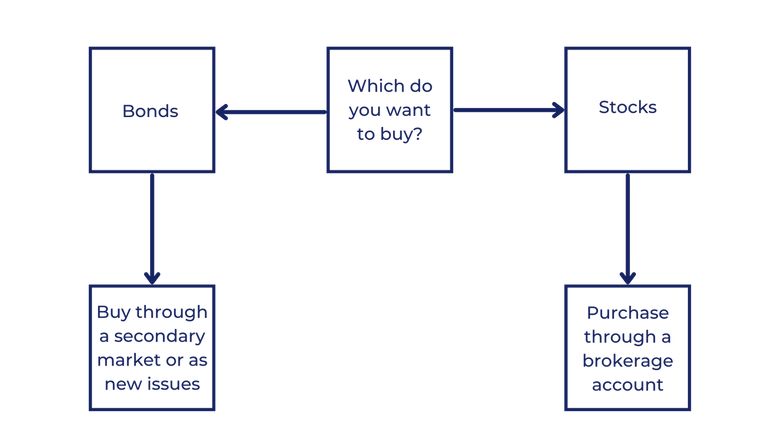

How to Invest in Each

Both stocks and bonds are relatively accessible investments for individuals. However, there are a few different avenues to choose from.

How to Buy Bonds

When buying bonds, you’ll want to decide whether to purchase them through a secondary market or as new issues.

If you want to buy resold bonds, you can find them through a brokerage, via specialty bond brokers or on public bond exchanges. However, pricing on secondary markets is often less transparent. Therefore, it may benefit inventors to conduct their own research to figure out what the bonds are worth.

Buying new issues can be a little bit more difficult, depending on the type of bond. For instance, US treasury bonds are relatively open to all investors. You’ll just have to go to the Treasury Direct website and participate in an auction, which occurs several times a year. However, buying new issue corporate bonds is a little bit more exclusive, as you’ll typically need an account with the brokerage managing the bond offering.

How to Buy Stocks

Buying stock investments is a relatively straightforward process. All you need to do is open up a brokerage account. If you don’t want to sign up with a personal broker, you can do so online with the help of a number of providers, including TD Ameritrade, Fidelity or Charles Schwab. Then, you can fund your account and start purchasing stocks.

Which is Right For You?

Stocks and bonds are both popular asset classes with their fair share of pros and cons. Typically, bonds are recommended to risk-averse investors who need liquidity in the near future. Contrastingly, stocks are considered a better option for investors with a longer investment horizon who prioritize strong returns.

For most investors, the best choice is to buy a combination of stocks and bonds. Some advisors recommend that the percentage of your portfolio should be 100 subtracted by your age. For example, if you’re 30 years old and following this advice, your portfolio would consist of 70% stocks, 30% bonds.

Due to the availability of diversified equity investments such exchange traded funds (ETFs), other investors may hold more aggressive asset allocations. However, the right division for you depends on your personal goals and lifestyle.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.